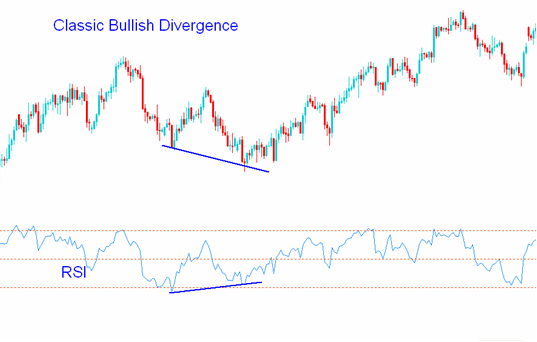

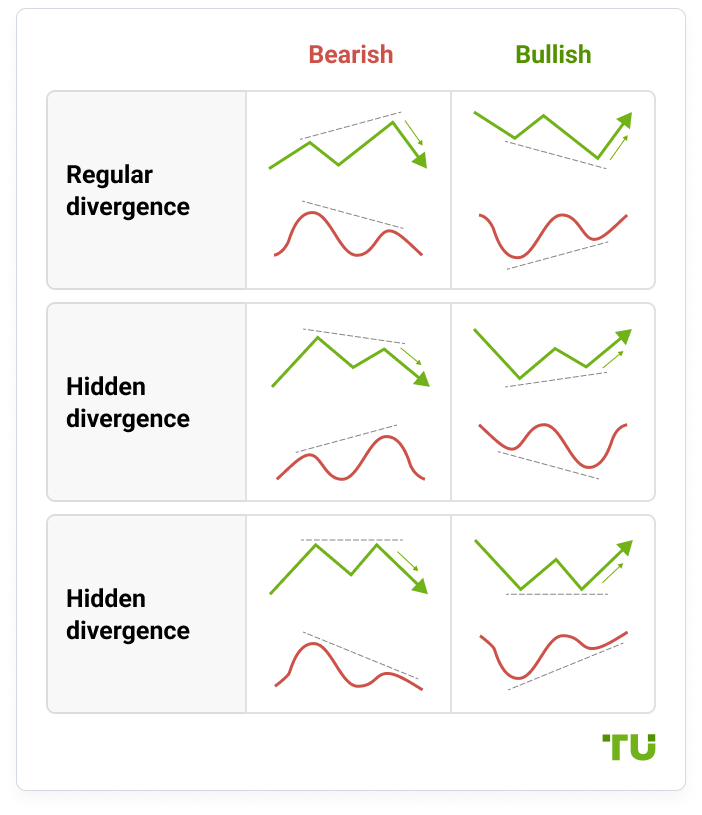

Let's start with the obvious question. We will explore the meaning of RSI Divergence actually is and what trading insights we can gain from it. If the price action and RSI indicators aren't in sync, a divergence is evident in the chart. This means that in downtrend markets in which the price action is making lower lows, while the RSI indicator makes lower lows. A divergence is essentially is when the indicator does not agree with the price action and when a situation similar to this occurs, you need to be attentive to the market. Based on the chart, both the bullish RSI divergence and bearish RSI divergence are clearly visible and the price action actually reversed after both RSI divergence signals. Is that right? Let's get to one last topic before move to the topic that is exciting. See the best stop loss for more advice including best trading platform, automated trading platform, forex backtesting software, trading platforms, bot for crypto trading, bot for crypto trading, crypto trading backtesting, automated trading platform, forex backtesting, divergence trading and more.

How Do You Assess The Divergence Of RSI?

Since we use the RSI indicator to detect trend reversals, It is very important to identify the right trend reversal, in order to do this, we need to have an uptrending market. Then we utilize RSI divergence to find the weak points in the current trend and then we can utilize this information to spot the trend reversal in the right moment.

How Do You Recognize Rsi The Presence Of A Divergence In Forex Trading

In the beginning of the trend at the beginning of the uptrend, both RSI indicator as well as Price Action performed the same process by making higher highs. This usually indicates that the trend is strong. However, at the end of the trend, Price forms higher highs. However, the RSI indicator made lower highs, which indicates that there's something to watch on this chart. This is the time to pay attention to market because the indicator and the price action aren't in of sync. This means there's an RSI deviation. The RSI divergence in this instance signifies a bearish trend change. Look at the graph to observe what transpired immediately following the RSI Divergence. The RSI Divergence is extremely specific in identifying trends that reverse. But how do you catch the trend's reverse? Let's take a look at four trade entry strategies that combine RSI divergence with higher probability signals. Follow the most popular divergence trading for blog recommendations including backtesting strategies, forex backtest software, crypto trading, crypto trading bot, automated forex trading, automated crypto trading, crypto trading bot, crypto trading bot, automated trading bot, trading divergences and more.

Tip #1 – Combining RSI Divergence and the Triangle Pattern

Triangle chart pattern comes with two variations. One of them is the ascending triangle pattern that used as a reversal pattern in an downtrend. The pattern of the descending triangle functions as an uptrend market pattern that reverses. Now, Have a look at the descending triangle pattern in the forex chart below. The market was in an uptrend and it eventually began to fall. RSI may also be a sign of divergence. These clues point out the weaknesses of this trend. Now , we can see that the uptrend that is currently in place has lost momentum. As a consequently, the price formed an descending triangle. This even confirms the reverse. It's now time to take the short-term trade. We used the exact same breakout techniques as previously. We'll now look at the third trade entry technique. We will combine trend structure and RSI diversification. Let's examine the best way to trade RSI divergence if the trend structure shifts. View the top trading divergences for site recommendations including best forex trading platform, crypto trading backtester, automated trading bot, trading platform, cryptocurrency trading bot, backtesting strategies, bot for crypto trading, forex backtester, RSI divergence cheat sheet, automated trading software and more.

Tip #2 – Combining RSI Divergence Pattern with the Head and Shoulders Pattern

RSI divergence is a tool used by forex traders to spot market Reversals. What if we combine RSI divergence with other factors that can cause reversals, such as the Head pattern? That increases our odds of making a trade. Now let's see how to make our trades more profitable by combining RSI divergence with the head and shoulders pattern. Related - How to Trade Head and Shoulders Patterns in Forex - A Reversal Trading strategy. Before we can think about a trade entry, we must be in a favorable market. Trending markets are preferred since we're trying discover a trend reversal. Here is the chart. Follow the top rated backtesting for website recommendations including automated forex trading, automated cryptocurrency trading, divergence trading, RSI divergence cheat sheet, divergence trading forex, backtesting, cryptocurrency trading, trading platform crypto, backtester, forex backtester and more.

Tip #3 – Combining RSI divergence with the trend structure

Trend is our good friend. As long as the market is trending, we need to invest in the direction of the trend. That's what the experts advise us. The trend does not last forever. It is likely to reverse. Let's now see how to recognize those reversals by observing the structure of the trend and RSI divergence. As we know, the uptrend is creating higher highs, while the downtrend produces lower lows. Let's take a look at the chart. The left-hand side of the chart shows the downtrend with an array of highs and lows. We will then have a closer look at the RSI Divergence (Red Line). The price action is what creates lows, but the RSI produces lower lows. What do these numbers mean? In spite of market-created lows, the RSI is doing exactly the opposite. This indicates that a trend that is continuing is losing its momentum. It is time to plan for a reverse. View the top rated automated crypto trading for site advice including trading platform cryptocurrency, bot for crypto trading, automated trading, backtesting, crypto trading backtester, forex backtesting, crypto trading, forex backtesting software, cryptocurrency trading, automated trading platform and more.

Tip #4 – Combining Rsi Divergence And The Double Top/Double Bottom

Double top or double bottom is a pattern of reversal that is formed following an extended movement or following an ongoing trend. Double top is formed after the price has reached a point that cannot easily be broken. Once it has reached that point it will bounce down a bit, only to return to the previous level again. A DOUBLE TOP occurs where the price bounces off that threshold. Double tops are below. In the double top above you will see that two tops formed after a good move. You will notice that the second top has not been able to break the top of the previous. This is a sure sign that a reversal is likely occur because it's telling buyers that they are struggling to go higher. The double bottom uses the same concepts, but it is carried out in the opposite direction. Here we will use the method of breakout entry. This is the place we employ the breakout entry method. The price is sold when it is below our trigger. Within a day, our take-profit was reached. Quick Profit. Double bottom is also a requirement for the same strategies for trading. Take a look at the graph below to learn how to trade RSI divergence in conjunction with double bottom.

Remember that this isn't the best all-traders strategy. There is no one perfect trading strategy. Every trading strategy has losses, and these losses are inevitable. This strategy lets us achieve consistent profit, but we have tight risk management and a way to quickly reduce our losses. That will reduce our drawdown which can open the door to big upside potential.